Driven by fear of an economic downturn, investor sentiment is deteriorating, and fintech companies without a clear and compelling business strategy may struggle to find the funding necessary to scale up the business and earn the return investors are seeking.

Market indexes have all shown signs of slowing. The S&P 500 is down 21% year-to-date (YTD), and equity markets in the UK, France, Germany, Japan, and Australia have also dropped in that timeframe.

While the slowdown is affecting all sectors, tech-focused markets are particularly affected. The Nasdaq Index is down almost 30% YTD, while London's FTSE AIM All-Share Index is down almost 26% YTD.

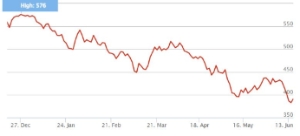

Fintech indices are reflecting the wider downturn in markets. The US-focused Index Developed Markets Fintech & DeFi Index is down 30% YTD, while the STOXX Global Fintech Index is down 30% YTD.

STOXX Global Fintech Index

Source: Stoxx, price in US$

Fidgety investors

A looming threat of a recession is putting greater pressure on markets. As investors show signs of greater conservatism in deploying capital, fintech firms without a strong business plan may find it more difficult to raise funds from private investors, while continued volatility in global markets suggest an initial public offering (IPO) may be met with less optimism. Amid such an environment, fintech boards and management may face greater hostility from investors if they don't address their risk exposure appropriately.

Business models based on a “buy now, pay later” service have noted that the Ukrainian war, a supply chain shortage, volatile stock markets, and depressed consumer behaviour are among the reasons for a more negative outlook.

The UK's Office for National Statistics(opens a new window) said June 14 that annual growth in regular pay, excluding bonuses, fell by 4.5% in April after adjusting for inflation – the biggest fall since comparable records(opens a new window) began in 2001. At the same time, inflation is getting close to double-digit territory, driving up household expenses as well as household debt.

Preparing for a more hostile environment

With these factors creating a nervy backdrop to fintech operations, some companies may find it particularly tough to attract new investors.

Existing investors may also be wary of deploying more capital to these ventures or may request to have a greater say in how capital is used.

Companies considering an IPO also face obstacles, with volatile markets perhaps dissuading investors from buying shares, especially if the initial price is perceived as high.

If seeking new capital from private or public investors, companies – specifically boards and management, may be under greater pressure to justify how capital is deployed and the company's performance.

Increasing risk for fintechs

Investors will scrutinise fintech investment cases more closely and could decide to take legal action against the management if the disclosures made prior to a funding round could be deemed incorrect or inaccurate.

Particularly risky aspects may include:

-

Growth plans: Ensuring that business plans set out a clear timeline for growth milestones will assist in creating realistic targets for management and will help investors to understand the environment of the company's operations.

-

Risk disclosures: Missing reference to some foreseeable risks that could threaten the company's growth plans can leave directors and management exposed to lawsuits and other actions. Ensuring all foreseeable risks are communicated clearly to investors will create clarity the obstacles a company faces, and what measures may need to be taken.

-

Allocation of capital: Demonstrating fiduciary responsibility with investor capital will always play a pivotal role in maintaining positive relationships. Communicating how and where money will be spent, and ensuring the right talent is brought into the correct areas of the business will help investors acknowledge the efficiency of the company.

Recommendations

In increasingly risky economic climates, it is more important than ever to ensure that companies are being run efficiently, with proper protection in place.

Some suggestions include:

-

Make business plans clear

-

Ensure talent is brought to the right areas

-

Set realistic and achievable targets

-

Ensuring you have adequate directors & officers (D&O) liability insurance in place

D&O protection in uncertain times

D&O insurance offers companies a way of providing protection to its board and management.

The policy works to cover directors and officers in the event that they are personally targeted by internal or external stakeholders – such as private or public investors – on a fiduciary basis.

For example, if a company's director is targeted by an investor, who blames their management for poor financial results, the policy can protect these individuals and their assets.

D&O insurance within the fintech industry is becoming increasingly important. If economies continue to slow, the threat of recession becomes greater. Investors may demand changes or blame individuals of a company for poor results. In this scenario, having a D&O policy in place will offer greater protection in an uncertain climate.

To discuss how a D&O policy works and how it may benefit your company, please contact:

April Bellchambers, Assistant Vice President

T: +447552001895